America’s hard workers, investors and economists are paying close attention to employment statistics. Economists estimate upwards of 15% of working age Americans are currently unemployed as a result of the COVID-19 pandemic. However, this figure has the potential to escalate to 30% or even higher in the weeks and months to come as the economic fallout of the virus fully manifests. Let’s take a look at the latest on our nation’s unemployment as well as the numbers coming out of the grocery and retail industries.

Unemployment in the COVID-19 Era

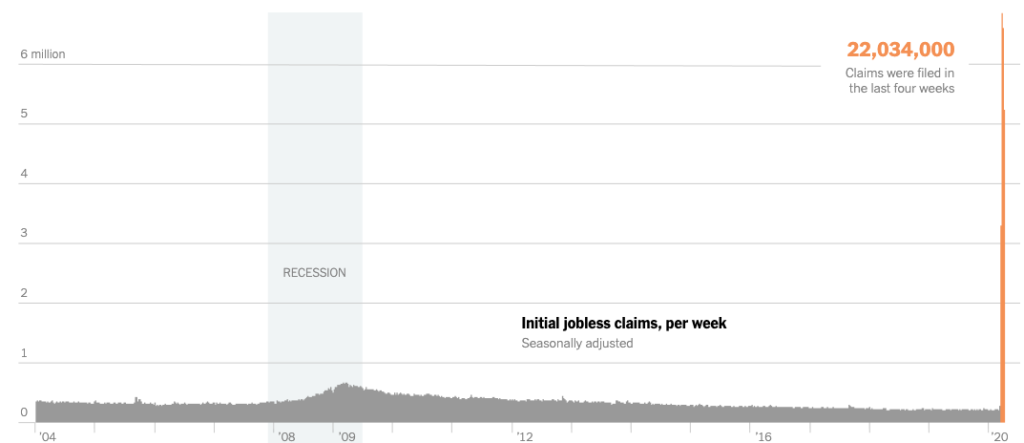

According to the New York Times, 5.2 million Americans recently joined the ranks of the unemployed. All in all, unemployment claims totaled an incredible 22 million across the past four weeks. This figure is even more shocking when you consider the fact that it equates to the net number of paying positions generated in the decade following the Great Recession.

Nearly every industry aside from the grocery/consumer essentials sector is vulnerable to cutbacks in the COVID-19 era. From construction to entertainment, technology, travel, hospitality, education and even white-collar office jobs, CoVid-19 has just about everyone in its cross-hairs.

The Impact on Retail

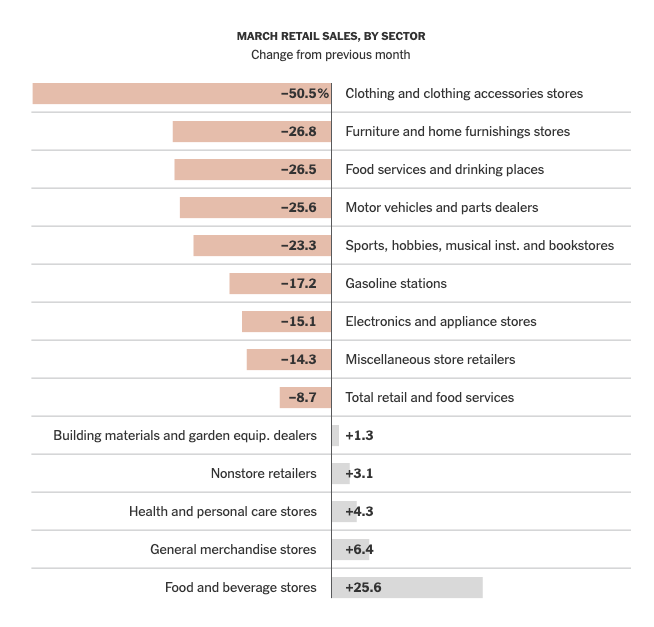

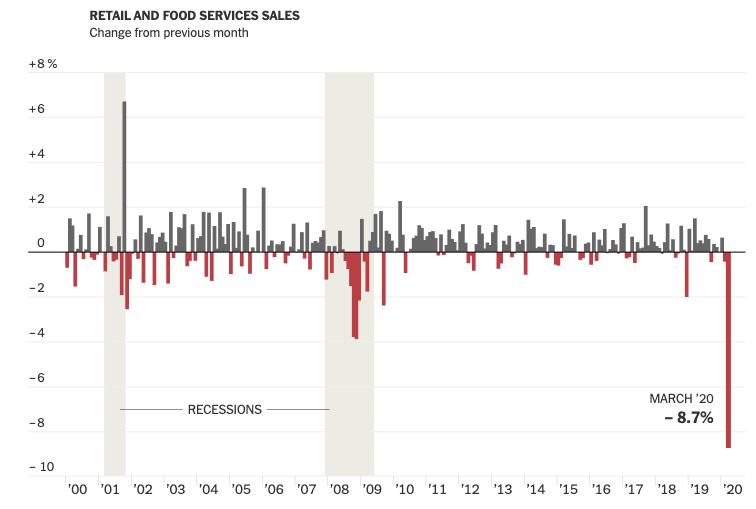

According to the Commerce Department, the United States recently experienced the sharpest monthly drop in retail sales across the past three decades or possibly even longer. Furthermore, industrial production has dropped more amidst the CoVid-19 pandemic than any time in the previous 70+ years. In short, the United States is not selling many items at retail stores nor is the country producing much of anything. This is a recipe for a prolonged recession if not a full-blown depression.

The likes of JCPenney, Neiman Marcus, True Religion and other former brick-and-mortar retail stalwarts are missing debt payments or declaring bankruptcy. It is clear the face of American retail is quickly changing – or should we say disappearing. Though some of the lost jobs will be replaced in the form of Amazon delivery truck drivers and grocery store positions, many of the unfortunate souls who become unemployed are unlikely to find a living wage job in the near future.

A Gradual Rather Than Rapid Recovery

The economy is likely to reopen in the weeks and months ahead. However, recently-formed regional pacts between governors will gradually reopen our nation’s economy a couple states at a time. Furthermore, there is the potential for a second wave to immobilize the country either later this year or next winter. Add in the fact that nervous and fearful customers will be hesitant to spend much time in stores aside from grocery markets and it is easy to see why most economists anticipate a slow recovery as opposed to “flipping the light switch” back on as some thought might be possible.

All in all, retail sales dropped nearly 9% in the month of March. Even if consumer confidence is somewhat renewed when governors eventually reopen their state economies, the increase in activity is unlikely to offset the 9% reduction. Sadly, many of those who turned to ecommerce markets on the internet will continue to shop from the comfort of home rather than support local business or even big box retailers in their town, city or village. The end result will be an elevated unemployment rate that remains quite high for months or possibly even years.

A Snapshot of Grocery Stores

Plenty of amateur economists errantly assume the money that would have been spent at shuttered retail stores is now being spent at grocery stores. However, this is not the case. As detailed in this informative CNBC write-up, the reduction in spending at the majority of retail categories stemming from stay-at-home orders outnumbers the bump in sales at grocery stores, pharmacies and online e-tailers such as Amazon.com. This is bad news for the economy as consumer spending is 66% of our nation’s economic activity. Even if panic buying at local grocery stores continues in the weeks and months ahead, it will not offset the reduction in spending in other key economic sectors, ultimately causing continued high unemployment and a significant reduction in GDP.

Sources